|

Everyone has purchased insurance at some point, but very few people understand how it works. This is no surprise as it can be confusing, so when people hear of insurance for animals they wonder: “What is pet insurance and why would I ever need it?” First, consider the things in your life you deem worthy of having insurance. You invest in car insurance because you want protection from negligent drivers. You have homeowners insurance to protect your precious, invaluable items from emergencies. And of course, you have health insurance for yourself because after all, there’s only one you. Pet parents feel the same way about their dogs and cats. Pets are not a burden, accessory, or nuisance to animal lovers — they’re part of the family. That’s why Prudent Pet has customizable insurance plans that work for your pet and your budget. Pet owners should be educated on all the nuances of insurance, as well as the cost and benefits of each plan. That’s why we broke down everything you need to know about pet insurance. ABOUT PET INSURANCE The most significant incentive for pet owners to insure their animals is the peace of mind and knowing they can receive financial recompenses if their pet becomes sick or has an accident. In this way, pet insurance is not unlike other forms of insurance. Pet insurance coverage reimburses you for certain medical and surgical expenses if your pet gets into an accident or becomes ill. The concept is simple and luckily, so is the process. HOW DOES PET INSURANCE WORK? Having coverage for your pet is not as complex as healthcare for people can often seem. When you buy pet insurance, you don’t need to worry about visiting vets that are in-network or accept certain kinds of insurance. You can visit any licensed veterinarian nationwide with your pet insurance. All you have to do is visit your vet and pay the bill like you usually would. Then, you submit a claims form with your vet receipts through email, mail, fax, or our online pet portal. Once your claim is submitted, you will get reimbursed for your costs via check or direct deposit. Pet parents often worry their vets will reject coverage or need to deal with the insurance provider directly. However, all you have to do is pay the bill and file your claim so we can refund you for the costs, which means less worry and stress on your part. HOW PLANS ARE BUILT Prudent Pet has Accident-Only and Accident & Illness plans, each with the option for Preventive Care add-ons for a little more cost. Our policies are built and tailored for the individual needs of your pet. Throughout the quoting process, you’ll find we request specific questions about your animal to determine which plan will work for them. These are three critical pieces of information taken into consideration when building a pet insurance policy:

HOW LONG IT TAKES TO GET REIMBURSED? Currently, all companies in the pet insurance space require you submit a claim to be reimbursed for your pet’s medical expenses. This means you will not find a pet insurance plan that reimburses you immediately. Reimbursement is a relatively quick process. On average, Prudent Pet policy holdersreceive their reimbursement within ten business days. The time period can fluctuate based on these factors:

WHAT DOES PET INSURANCE COVER? Your coverage depends on the pet insurance policy you purchased for your animal. This means that coverage is different between Accident-Only and Accident & Illness plans and varies based on whether or not you included a Preventive Add-On. No pet insurance company currently covers pre-existing conditions. It’s also important to note the difference between pre-existing conditions and hereditary conditions. Pre-existing conditions are defined as ailments and issues noted by you or your veterinarian before your policy becomes active or during a waiting period. Hereditary conditions are genetic disorders inherited by your pet, often because of their breed. Hereditary conditions are covered, so long as they are not pre-existing. However, with Prudent Pet, pre-existing conditions can still be covered in the future. Any injury or illness that is cured and doesn’t show symptoms or need treatment for 180 days is no longer regarded as pre-existing (knee and ligament conditions excluded). If knee or ligament conditions occur before the coverage effective date or during waiting periods, then future ones will not be covered. COMMON CONCERNS Pet owners hesitate to purchase pet insurance policies in fear it will not cover various conditions they will need. That is why it’s essential to carefully read through the benefits of each plan to ensure you are purchasing pet insurance that works for you and your pet. The list of covered conditions usually depends on the plan you bought and the cause of the needed treatment. Below are some of the most common concerns regarding what is covered by pet insurance, and which plan is the best option for each situation.

An Accident & Illness plan will cover surgeries needed from accidents and surgeries that are the result of an illness (if your pet needs a fatty lump or tumor removed, for example). In short, surgeries are always covered by Prudent Pet under their appropriate plans unless they are the result of a pre-existing condition or otherwise not eligible for coverage.

If you purchase Accident-Only pet insurance, you will be reimbursed actual costs for covered expenses related to the diagnosis and treatment of injuries resulting from an accident subject to your reimbursement percentage after your deductible is met, up to the annual limit noted on your policy. Below is a list of eligible accident expenses included with an Accident-Only policy: Accident Benefits

Below is a list of eligible illness expenses included with an Accident & Illness policy: Illness Benefits

Optional Coverage: Preventive Prudent Pet currently has two preventive coverage options for a little more cost: Basic Preventive Care and Prime Preventive Care. These are optional add-ons that can be included for extra preventive coverage not included on your policy; for example, if you need pet insurance that covers vaccinations. Preventive coverage must be added on with an Accident-Only or Accident & Illness plan. Preventive care cannot be purchased individually as a stand-alone plan. You will be reimbursed up to a specific dollar amount, not percentage, for Preventive Care. Note that prices of preventive care from your veterinarian vary based on location. Basic Preventive:

Prime Preventive:

Note: There is no waiting period for Preventive Care, and you do not need to meet your deductible to be reimbursed for preventive treatment. Preventive care payments are based on a scheduled amount. WHAT PET INSURANCE DOES NOT COVER Like other types of insurance, certain conditions and situations are excluded and therefore will not be covered by your pet insurance policy. Prudent Pet does not currently pay for costs associated with, or resulting from, the following:

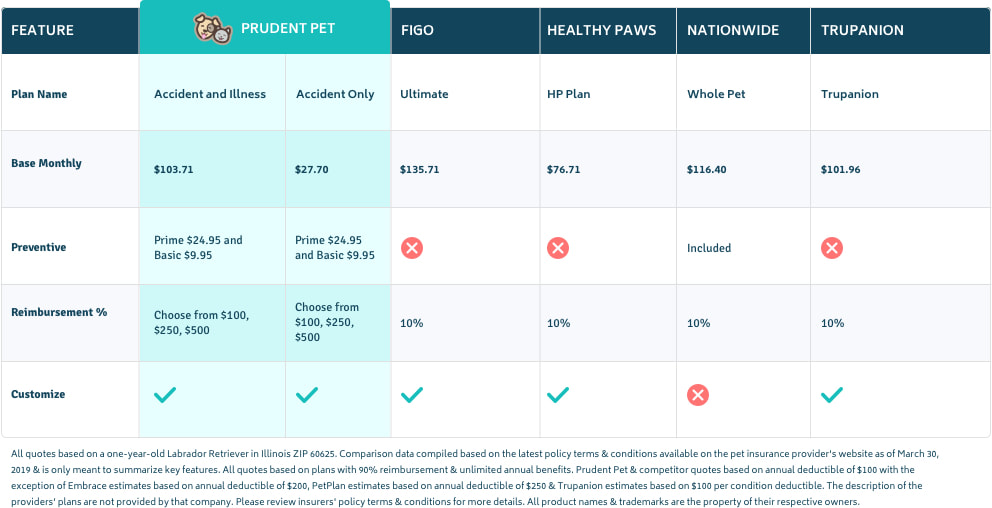

HOW PRUDENT PET COMPARES TO OTHER INSURANCE Some key offerings make Prudent Pet unique compared to other leading pet insurance companies.

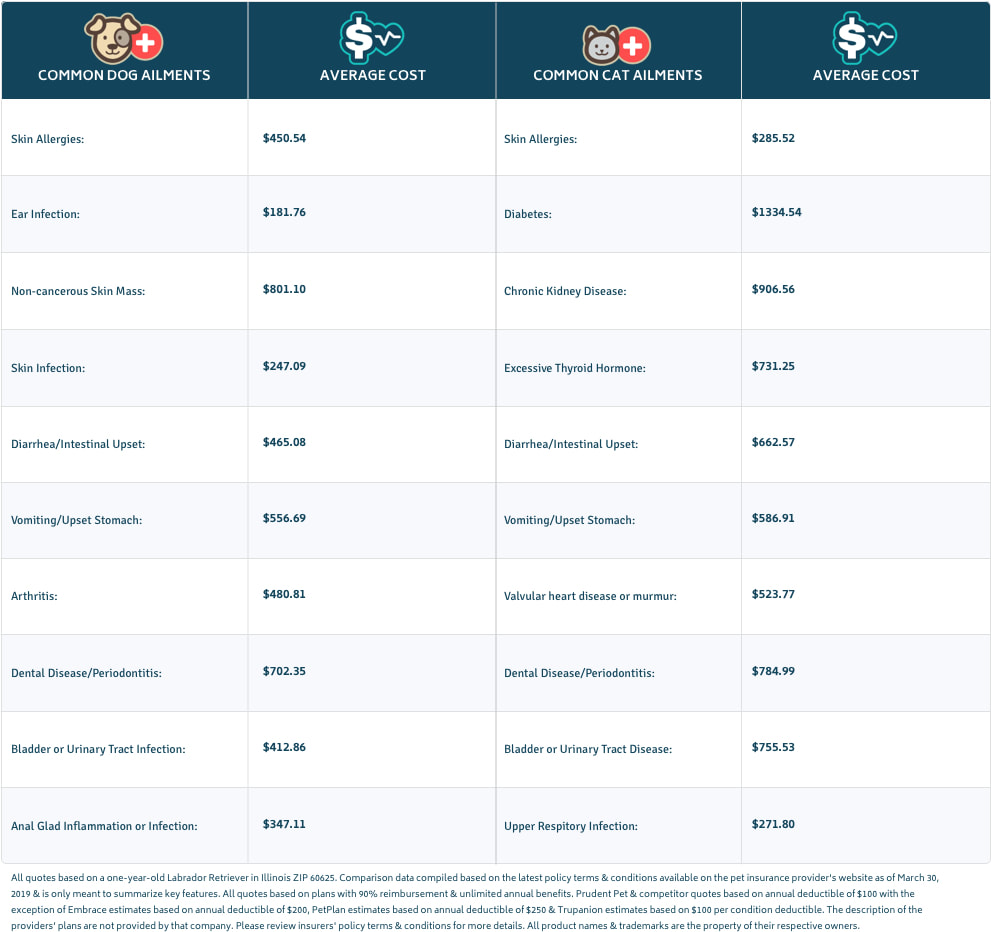

IS PET INSURANCE WORTH IT? Pet owners should purchase a pet insurance policy that not only works for their budget, but also for their animal’s individual needs. In the event of an accident or illness, is your pet covered? When deciding on a plan, the monthly or yearly cost of a policy is merely one consideration. Knowing you have a plan that will help pay for your pet’s needed medical expenses is most important. Being a pet owner is expensive, and even routine checks can add up fast: The average cost of a wellness check: $52.90 The average price of a dental cleaning: $204.75 Policy holders can receive up to 90% reimbursements after the deductible is met and up to the annual limit, based on the plan chosen, for common medical expenses like the ones listed above. WHAT YOU PAY WITH PET INSURANCE As you learned, Prudent Pet plans are built and customized based on breed, age, location, and policy choice. Below are what policy holders pay annually, on average, for Prudent Pet insurance: Average annual premium for dogs is between $525.00 – $575.00. Average annual premium for cats is between $425.00 – $475.00. Keep in mind, the cost of the annual premium is small compared to the cost of treatment for common ailments in dogs and cats. These ailments can be expensive and are also likely to be reoccurring issues throughout your pet’s life. WHAT YOU PAY WITHOUT PET INSURANCE Below are the costs of treatment for common ailments in dogs and cats without pet insurance: Source: Based on Average Crum & Forster Claims HOW MUCH YOU CAN SAVE WITH PRUDENT PET So how do pet parents measure the savings? Policy holders can be reimbursed yearly up to the annual maximum, between $5,000 and $10,000 depending on the chosen policy. Think of it this way: most people cannot set aside upwards of $10,000 in cash yearly for pet-related conditions. With pet insurance, you don’t have to worry about it. Owning a policy means assurance that your pet is covered (and your wallet is reimbursed) in the event of an accident or illness. Here’s an example of how much you could potentially save with a Prudent Pet policy: Buster is an excitable 6-year-old Chocolate Lab. He was sniffing around and playing in his backyard when he ingested one of his toys. The vet says Buster will need exploratory surgery that costs $5,082.00. Luckily, Buster’s parents have Prudent Pet, so they get reimbursed $4,573.80! In this common and very likely instance, policy holders end up paying just $508.2 for much-needed surgery, while non-policy holders are stuck with a bill over $5,082. WHAT PET INSURANCE DO I NEED? There is no right or wrong answer; the truth is, the best pet insurance policy is one that works for both you and your pet. Every pet is different which is why Prudent Pet has customizable plans with optional coverage, so you can make sure your policy covers everything necessary. Choose the coverage you need. Get a free pet insurance quote from Prudent Pet today. Comments are closed.

|

Categories

All

REAL DOG MOMS OF CHICAGOOur goal is to connect dog rescues, dog-friendly businesses & dog lovers. Based in Chicago, Illinois, we host fun events for dogs & humans at great places with all proceeds going to local dog rescues. Archives

December 2023

|

|

© 2017-2021 Real Dog Moms of Chicago

All Rights Reserved

|

RSS Feed

RSS Feed